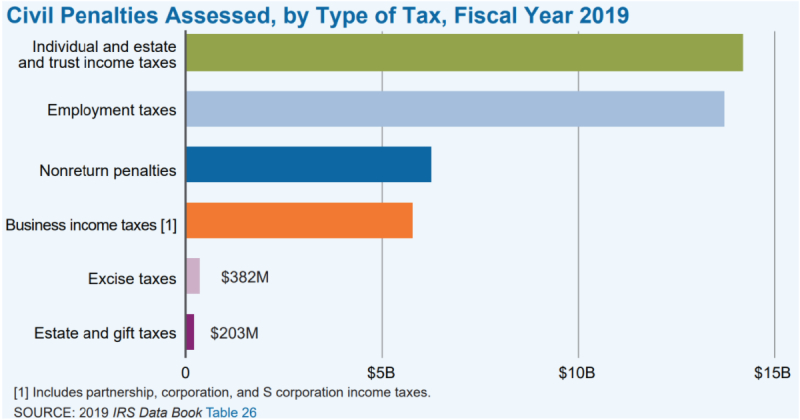

The IRS slaps tax debtors with a slew of fines every year.

How much is it, exactly? If you live in Charlotte and owe taxes, you should look into it...

To put this in context, the IRS budget for 2021 is estimated to be over $12 billion. That implies the IRS could pay its entire operation this year only via the penalties it imposes on individuals and small companies. This contains residents of Gastonia who owe the IRS money.

When you're hit with these penalties, it can feel like the IRS is simply adding salt to the wound. The last thing you want to see when you can't pay your taxes is...more taxes. Fortunately, the IRS offers a variety of penalty relief choices.

Abate for the First Time

If you or someone you know in Charlotte is qualified for penalty relief, the IRS offers a rather simple administrative procedure:

- Non-filing of a tax return

- Failure to pay taxes when they became due

- Payroll taxes are not deposited in a timely manner.

To be eligible for penalty relief. Filing an extension request for your 2020 tax return is totally acceptable and will count toward your eligibility for this programme. Additionally, if the IRS has filed your tax return for you, this does not count. As a result, you'll have to file a new tax return to replace the one the IRS prepared for you (which is fine because those are almost always wrong anyway and definitely not in your favor).

Furthermore, you must take the essential procedures to resolve the unpaid tax debt. To be eligible for penalty relief, you or Charlotte filers in your circumstances must either pay off the tax amount or engage into a payment plan. The IRS can put you in a special non-collectible category if you're in a tight spot and can't afford to make monthly payments on your tax bill. The disadvantage is that you will be ineligible for penalty reduction.

This administrative penalty waiver is available to you or other Charlotte taxpayers every few years. The IRS requires that you have a spotless record with them for at least the three years before the year for which penalty relief is sought. If you submitted your 2019 tax return late and were punished, the IRS will only waive your fines if you were penalty-free in 2016, 2017, and 2018. So, while this programme is referred to as a "first time" abate, it actually refers to "first time after three years."

When you owe taxes for numerous years and so have several years of penalties in a succession, you can only get penalty relief for the first year in the sequence due to the three-year rule. For example, if you owe taxes and filed late from 2016 to 2019, you'll only be eligible for a penalty reduction on the 2016 tax obligation at best.

Penalty Relief for Reasonable Cause

The First Time Abate programme is a well-defined procedure. It's either you're eligible for it or you're not. The IRS, on the other hand, recognises that things aren't always that simple for folks all around the country, including those in Gastonia.

The IRS will consider a valid excuse if you failed to file a tax return or pay your taxes on time. Something to bear in mind if you or anyone you know in Charlotte owes taxes. Nonetheless, they have particular guidelines for evaluating such petitions, and judgments are made on a case-by-case basis.

The IRS is searching for proof that you made reasonable attempts to comply with the tax rules but were unable to do so due to circumstances beyond your control in order to grant penalty relief in certain scenarios. It's difficult to file your own tax return if you're dead, for example. Isn't that ridiculous? But you wouldn't believe some of the things I've seen!

Consider the following questions to see if things were “out of your control.”

- Were you or a member of your family hospitalised?

- Have you had to deal with the loss of a loved one?

- Was your neighbourhood impacted by a natural disaster?

- Have you ever been a victim of identity theft?

- Were there any concerns with drugs, alcohol, gambling, or other addictions?

If you or someone in your immediate family (or anybody you know in Gastonia) has had any of these problems, you may be able to make a case for penalty abatement based on reasonable cause. If any of them apply to you, we'll need to have a painful talk so that I can try to connect the dots between your circumstances and your failure to file or pay taxes.

Make a Compromise Offer

Because so few individuals ever qualify for this, I'm hesitant to even bring it up. This is the infamous "pennies on the dollar" settlement about which you may have heard rumours. It does exist, but it is subject to very severe eligibility requirements. In 2019, the IRS accepted less than 18,000 of these lower settlements across the country.

Still, here's why I bring it up: if you're eligible, the IRS will suddenly remove all of your fines and interest. That's correct... They're all of them.

There's no need for an explanation. There are no justifications to be offered.

If you are in such desperate financial difficulties that you qualify for this programme, your whole tax bill, fines and everything, is simply erased. For Charlotte taxpayers who have gotten themselves into trouble with the IRS, this could be some potentially exciting news.

Nonetheless, with all of these laws and unique criteria, this is definitely not something you or anybody you know in Charlotte should attempt. If you owe the IRS money, you'll almost certainly face fines. Let's set up a time to discuss your options:

https://calendly.com/saragonzalez

We’re in your corner…

Warmly,

Sara Gonzalez

Kohari & Gonzalez PLLC