Are Your QuickBooks a bit of a mess? Clean up your small business' bookkeeping to kick off 2022.

Article Highlights:

- Crucial Reports

- Past-due Payments

- Inventories

Are your QuickBooks business files up to date for 2022? Wondering how to use QuickBooks to the max? Here are the three most important things you can do to get your record-keeping in order.

January is always a month of transition. We're all attempting to complete the tasks that we ‘tucked away for later’ during a frantic December. We’re all guilty of it! As well as recovering from holiday festivities, January is the time to embrace a new year. It’s our opportunity to find our old groove, and to start new rhythms and patterns that will help us in 2022. It can be difficult to work out which year you're working in at times.

While you're catching up on 2021 and planning for 2022, don't forget about QuickBooks. You maayyybe don't want to add another task to your to-do list, but any measures you take now to get your QuickBooks ready for the new year will pay off in the long run. A fresh, clean, organized QuickBooks will make life so much easier once normal life' returns, with its constant flow of transactions, orders, and new clients. You'll thank your past self, we promise!

Here are some suggestions for completing as much of the work you started in 2021 as you can.

Execute four crucial reports.

Because there is so much going on in December, it's likely that bills may get forgotten about and go unpaid. This is true for both you and your clients. You must pay attention to what is owed to you and what you owe. So, in QuickBooks, create the following four reports:

- Aging Detail for A/R. Which of your clients is delinquent in making payments to you? How much money do they owe you, and when should it have arrived?

- Unpaid Invoices. What invoices haven't been paid yet? Although A/R Aging Detail might duplicate some of these results, this report isolates unpaid transactions, so you can clearly see your priority cases.

- Aging Detail for A/P. Are you behind on the payments you owe to other people and businesses? This report will give you everything you need to know.

- Unpaid Bill Detail. This report, like Unpaid Invoices, separates only the bills with unpaid balances.

Prepare statements for consumers who are past due on their payments.

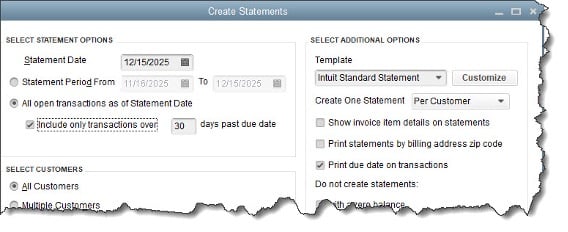

If you don't want to engage directly with late-paying consumers, you can use QuickBooks to send statements as a collection technique.

When it's so early in the year, you'll have to consider how much you want to pursue clients who are late paying their payments. If some clients are more than 60 days past due (30 days if they have large sums), you should definitely call them or send them a personalized email asking them to meet their responsibilities. To avoid misunderstandings or miscommunications, it's usually best to have these (often difficult) conversations concerning late payments over the phone.

You can, however, send statements in QuickBooks itself. These documents detail the financial transactions between you and your customers during a specific period. Click ‘Create Statements’ from the ‘Customers’ menu. Examine all the options in the pop-up box and select your favorites. If your consumers don't respond to your statements within 10 days, it's time to call them.

Examine your inventory carefully.

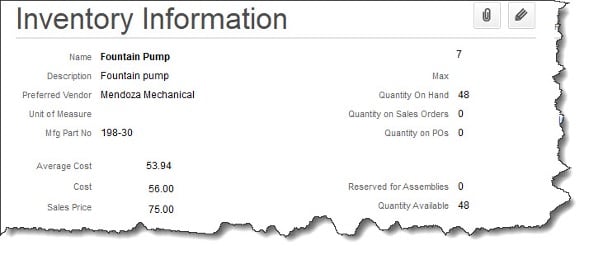

It may have been a while since you did this, but it's critical to do so on a regular basis, especially if you had a very hectic holiday season. The best method to get started is to go to the ‘Vendors’ menu, scroll down to ‘Vendor Activities’, and then click ‘Inventory Center’.

If you don't have a lot of inventory, you can just highlight each entry under ‘Active Inventory, Assembly’ on the left side. The window on the right side of the screen contains so much information on each item. However, if you sell a wide variety of things, this could be incredible time-consuming. In that instance, generate one or more of the reports linked from this screen. Even QuickReport can be beneficial. Save yourself some time and energy for those other new year, new me tasks!

In QuickBooks' Inventory Center, you can access a lot of information about particular things you sell.

Tip: To change the quantity available, go to the lower left and click the down arrow next to Manage Transactions, then select Adjust Quantity/Value on Hand. If you're having trouble with this, you can talk to us about it. We can go over inventory concerns with you. Always feel free to arrange a consultation to get help with your QuickBooks accounting.

Set Up Your Web Financial Connections

January is also a good time to consider how you might improve your QuickBooks usage in 2022. When it comes to software, we all are tempted to only learn how to use the tools we need and then not go any farther. Because QuickBooks is such a large and multi-layered programme, this is common. We get it! Why not set yourself a little resolution to learn at least five more functions and features of QuickBooks in the next six weeks.

Right now, though, there are two tools that we can recommend. These technologies will have a significant impact on your daily workflow, ability to get paid faster by consumers, and comprehension of your financial situation on a regular basis. They are as follows:

- Online Banking. Did you know that QuickBooks can connect to a variety of financial institutions and banks, and import your daily cleared transactions? This is what ‘The Bank Feeds Center’. You won't have to wait until your monthly statement arrives to see what transactions have gone through if you sign up for this service.

- Online transactions. If you only accept checks from your customers as payment, you're probably getting paid slower than you should be. If you sign up for QuickBooks Desktop Payments, you'll be able to make payments from your computer. you’ll be able to process eChecks, credit cards, and ACH payments.

We also recommend downloading and getting familiar with the QuickBooks online accounting app, which will make it even easier and quicker to check on your records.

Of course, everyone is currently catching up after the holiday vacation. If you need more help with QuickBooks, you can read this article on the basics of setting up the software. Blogs giving up-to-date advice on how to use QuickBooks are regularly published. Please contact us if you need assistance with anything that we’ve addressed in this article. We're always happy to schedule a meeting to chat with you about your accounting and QuickBooks record-keeping.

Here's to a successful and productive 2022!