Relief For Some 2023 IRA RMDs

Article Highlights:

- IRA Owners Turning 72 in 2023.

- Required Minimum Distribution Not Required Until April 1, 2025.

- 60-Day Rollover Period

- Rollover Period Extended Until September 30, 2023.

On July 14, 2023, the IRS issued Notice 2023-54 announcing that traditional IRA owners who will attain age 72 in 2023 (that is, individuals born in 1951) will have to take their first required minimum distribution (RMD) by April 1, 2025, rather than April 1, 2024.

This delay in the required beginning date means that these IRA owners (who, prior to enactment in late December 2022 of the SECURE 2.0 Act, would have been required to take minimum distributions from their IRAs for 2023) will have no RMD due from their IRAs for 2023. Thus, the first distribution for these IRA owners that will be treated as an RMD will be a distribution made for 2024, not 2023.

The significance of this for an individual having their 72nd birthday in 2023 is that IRA distributions in 2023 mischaracterized as 2023 RMDs will be eligible to be rolled back into their IRA account. Thus, the portion of the distribution that is redeposited will avoid tax in 2023. Tax law doesn’t allow RMDs to be rolled over, so this is why the IRS is identifying these distributions as mischaracterized RMDs and eligible for rollover.

The normal period allowed for a rollover is 60 days from the time of the distribution. But to accommodate those who would have preferred not to take this mischaracterized distribution in 2023, the IRS extended the 60-day rollover period to September 30, 2023 for IRA owners and IRA owners’ surviving spouses.

There is also a 12-month waiting time between IRA rollovers but for purposes of the extended rollover period for mischaracterized distributions, the rollover is allowed even if the IRA owner or their surviving spouse has rolled over a distribution within the last twelve months. However, making such a rollover of the mischaracterized IRA distribution would prevent the IRA owner or surviving spouse from rolling over another IRA distribution in the next twelve months.

If you have questions, please contact this office.

Divorced, Separated, Married or Widowed This Year? Unpleasant Surprises May Await You at Tax Time

Article Highlights:

- Separated Taxpayers

- Divorced Taxpayers

- Recently Married Taxpayers

- Widowed Taxpayers

- Filing Status

- Joint and Several Liability

- Who Claims the Children

- Alimony

- Community Property States

- Affordable Care Act

Taxpayers are frequently blindsided when their filing status changes because of a life event such as marriage, divorce, separation or the death of a spouse. These occasions can be stressful or ecstatic times, and the last thing most people will be thinking about are the tax ramifications. But the ramifications are real and need to be considered to avoid unpleasant surprises. The following are some of the major tax complications for each situation.

Separated – Separating from a spouse is probably the most complicated life event and is certainly stressful for the family involved. For taxes, a separated couple can file jointly, because they are still married, or file separately.

- Filing Status – If the couple has lived apart from each other for the last 6 months of the year, either or both of them can file as head of household (HH) provided that the spouse(s) claiming HH status paid over half the cost of maintaining a household for a dependent child, stepchild or foster child. A spouse not qualifying for HH status must file as a married person filing separately if the couple chooses not to file a joint return. The married filing separate status is subject to a host of restrictions to keep married couples from filing separately to take unintended advantage of the tax laws.

In most cases, a joint return results in less tax than two returns filed as married separate. However, when married taxpayers file joint returns, both spouses are responsible for the tax on that return (referred to as joint and several liability). What this means is that one spouse may be held liable for all of the tax due on a return, even if the other spouse earned all of the income on that return. This holds true even if the couple later divorces, so when deciding whether to file a joint return or separate returns, taxpayers who are separated and possibly on the path to a divorce should consider the risk of potential future tax liability on any joint returns they file.

- Children – Who claims the children can be a contentious issue between separated spouses. If they cannot agree, the one with custody for the greater part of the year is entitled to claim the child as a dependent along with all of the associated tax benefits. When determining who had custody for the greater part of the year, the IRS goes by the number of nights the child spent at each parent’s home and ignores the actual hours spent there in a day.

- Alimony – Alimony is the term for payments made by one spouse to the other spouse for the support of the latter spouse. Under tax law prior to tax reform, the recipient of the alimony includes it as income, and the payer deducts it as an above-the-line expense, on their respective separate returns. The tax reform rule is that alimony is non-taxable to the recipient if it is received from divorce agreements entered into after December 31, 2018, or pre-existing agreements that are modified after that date to treat alimony as non-taxable. Therefore, post-2018 agreement alimony cannot be treated by the recipient as earned income for purposes of an IRA contribution and can’t be deducted by the payer.

A payment for the support of children is not alimony. To be treated as alimony by separated spouses, the payments must be designated and required in a written separation agreement. Voluntary payments do not count as alimony.

- Community Property – Nine U.S. states – Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin – are community property states. Generally, community income must be split 50–50 between spouses according to their resident state’s community property law. This often complicates the allocation of income between spouses, and they generally cannot file based upon just their own income.

Divorced – Once a couple is legally divorced, tax issues become clearer because each former spouse will file based upon their own income and the terms of the divorce decree related to spousal support, custody of children and division of property.

- Filing Status – An individual’s marital status as of the last day of the year is used to determine the filing status for that year. So, if a couple is divorced during the year, they can no longer file together on a joint return for that year or future years. They must, unless remarried, either file as single or head of household (HH). To file as HH, an unmarried individual must have paid over half the cost of maintaining a household for a dependent child or dependent relative who also lived in the home for more than half the year (exception: a dependent parent need not live in their child’s home for the child to qualify for HH status). If both ex-spouses meet the requirements, then both can file as head of household.

- Children – Normally, the divorce agreement will specify which parent is the custodial parent. Tax law specifies that the custodial parent is the one entitled to claim the child’s dependency and associated tax benefits unless the custodial parent releases the dependency to the other parent in writing. The IRS provides Form 8332 for this purpose. The release can be made for one year or multiple years and can be revoked, with the revocation becoming effective in the tax year after the year the revocation is made.

Family courts often award joint custody to the parents. In that case, if the parents cannot agree on which of them will claim a child as a tax dependent, then the IRS’s tie-breaker rule will apply. This rule specifies that the one with custody the greater part of the year, measured by the number of nights spent in each parent’s home, is entitled to claim the child as a dependent. The parent claiming the dependency is also eligible to take advantage of other tax benefits, such as childcare and higher education tuition credits.

Alimony –See alimony under “separated”.

Recently Married – When a couple marries, their incomes and deductions are combined, and they must file as married individuals.

- Filing Status – If a couple is married on the last day of the year, they can either file a joint return combining their incomes, deductions and credits or file as married separate. Generally, filing jointly will provide the best overall tax outcome. But there may be extenuating circumstances requiring them to file as married separate. As mentioned earlier, married filing separate status is riddled with restrictions to keep married couples from taking undue advantage of the tax laws by filing separate returns. Best look before you leap.

- Combining Income – The tax laws include numerous provisions to restrict or limit tax benefits to higher-income taxpayers. The couple’s combined incomes may well be enough that they’ll encounter some of the higher income restrictions, with unpleasant tax results.

- Affordable Care Act – If one or both spouses acquired their health insurance through a government marketplace and were receiving a premium supplement, their combined incomes may exceed the eligibility level to qualify for the supplement, which may have to be repaid.

Widowed – When one spouse of a married couple passes away, a joint return is still allowed for the year of the spouse’s death. Furthermore, the widow or widower continues to use the joint tax rates for up to two additional years, provided the surviving spouse hasn’t remarried and has a dependent child living at home. This provides some relief for the survivor, who would otherwise be straddled with an unexpected tax increase while also facing the potential loss of some income, such as the deceased spouse’s pension and Social Security benefits.

If any of these situations are relevant to you or a family member, please call for additional details that may also apply with respect to your specific set of circumstances.

What’s Best, FSA or HSA?

Article Highlights:

- Employer Medical Fringe Benefits.

- Flexible Spending Account (FSA).

- FSA Annual Contribution Limits.

- FSA Limited Annual Carryover Provisions.

- Health Savings Account (HSA).

- HSA Qualifications.

- High Deductible Insurance.

- HSA as a Retirement Vehicle.

- Comparison Table.

Many employers offer health flexible spending accounts (FSAs) an health savings accounts (HSAs)

as part of their employee benefits packages. Both plans allow you to set aside money to pay medical expenses with pre-tax dollars, providing a significant tax benefit. But which is the better option?

Although FSAs are only available through an employer, you may be able to open an HSA on your own if you have an HSA-eligible health plan through work, your spouse's employer, private insurance, or the insurance marketplace.

You don’t pay taxes on this money. This means you’ll save an amount equal to the taxes you would have paid on the money you set aside. Employers may make contributions to your FSA, but they aren’t required to. With an FSA, you submit a claim to the FSA (through your employer) with proof of the medical expense and a statement that it hasn't been covered by your plan. Then, you’ll get reimbursed for your costs.

To learn more about FSAs, contact your employer for details about your company’s FSA, including how to sign up. Facts about Health Flexible Spending Accounts (FSA):

- The amount you can put into an FSA for 2023 is limited to $3,050 per employer. If you’re married, your spouse can put up to $3,050 in an FSA with their employer too. The amount is indexed for inflation each year.

You can use funds in your FSA to pay for certain medical and dental expenses for you, your spouse if you’re married, and your dependents.

- You can spend FSA funds to pay deductibles and copayments, but not for insurance premiums.

- You can spend FSA funds on prescription medications, as well as over-the-counter medicines with a doctor's prescription. Reimbursements for insulin are allowed without a prescription.

- FSAs may also be used to cover costs of medical equipment like crutches, supplies such as bandages, and diagnostic devices like blood sugar test kits.

- You generally must use the money in an FSA within the plan year. But your employer may offer one of 2 options:

- It can provide a "grace period" of up to 2-½ extra months to use the money in your FSA.

- It can allow you to carry over up to $610 per year (the 2023 inflation adjusted amount) to use in the following year.

Your employer doesn’t have to offer these options. If it does, it can be either one of these options, but not both.

Don’t put more money in an FSA than you think you'll spend within a year on things like copayments, coinsurance, drugs, and other allowed health care costs.

While you can use the funds in an HSA at any time to pay for qualified medical expenses, you may contribute to an HSA only if you have a High Deductible Health Plan (HDHP) — generally a health plan (including a Marketplace plan) that only covers preventive services before the deductible. For plan year 2022, the minimum deductible for an HDHP is $1,500 for an individual and $3,000 for a family. When you view plans in the Marketplace, you can see if they’re "HSA-eligible."

For 2023, if you have an HDHP, you can contribute up to $3,850 for self-only coverage and up to $7,750 for family coverage into an HSA. HSA funds roll over year to year if you don't spend them. An HSA may earn interest or other earnings, which are not taxable if used for qualified medical expenses. Some health insurance companies offer HSAs for their HDHPs. Check with your company. You can also open an HSA through some banks and other financial institutions.

Establishing and contributing to an HSA can be more than just a way for individuals to save taxes and gain control over their medical care expenditures. It can also be a retirement vehicle, especially for taxpayers who are maxed out on their other retirement plan options or who can’t contribute to an IRA because of the income limitations. There is no requirement that medical expenses must be paid or reimbursed from the HSA, so a taxpayer can maximize tax-free growth in the account by using funds from other sources to pay routine medical costs. Later, distributions can be used tax-free to pay post-retirement medical expenses. Or, if used for non-medical purposes, an individual aged 65 or older will pay income tax, but not a penalty, on the distribution. Unlike IRAs, no minimum distributions are required to be made from HSAs at any specific age.

|

FSA and HSA COMPARISONS |

||

|

DIFFERENCES |

FSA |

HSA |

|

Funds not used for medical purposes carry over year to year |

Limited |

Yes |

|

Contributions are pre-tax |

Yes |

Yes |

|

Contributions may be tax deductible |

--- |

Yes |

|

You must have high deductible medical insurance to qualify |

No |

Yes |

|

The plan is only available through an employer |

Yes |

No |

|

Funds can be invested for tax-free growth |

No |

Yes |

|

Can be used as a retirement vehicle |

No |

Yes |

|

Plan belongs to employer |

Yes |

No |

As you can see an HSA allows larger contributions and retirement options but requires high deductible medical insurance to qualify. While an FSA is only available if your employer offers an FSA as an employee benefit, but only has limited carryover of unused funds.

If you have further questions related to HSAs and FSAs, please give this office a call.

Seasonal Summer Employees Can Provide Tax Benefits

Article Highlights:

- What is the Work Opportunity Tax Credit?

- Maximum Credit

- Who Can Claim the Credit?

- Qualified Employees

- Pre-screening and Certification

- Tax-exempt Employers

Summer is upon us, which signals the need for seasonal employees to fill in for workers who are on vacation during the busy months ahead and even for some gearing up for the upcoming hectic holiday season. However, given the current labor shortage many businesses are facing a tight jobs market. So, it may be time to become creative.

One solution might be hiring family members. Financially, it makes more sense to keep the family employed rather than hiring strangers, provided, of course, that the family member is suitable for the job.

You might even consider hiring your children to work in your business. Rather than helping to support your children with your after-tax dollars, you can instead hire them in your business and pay them with tax-deductible dollars. Of course, the employment must be legitimate and the pay commensurate with the hours and the job worked.

Another solution might be hiring long-term unemployment recipients and other groups of workers facing significant barriers to employment. Doing so may allow you to benefit from the Work Opportunity Tax Credit (WOTC).

The Work Opportunity Tax Credit (WOTC) is a general business tax credit that is jointly administered by the Internal Revenue Service (IRS) and the Department of Labor (DOL). The WOTC is available for wages paid to certain individuals who begin work on or before December 31, 2025.

The WOTC may be claimed by any employer that hires and pays or incurs wages to certain individuals who are certified by a designated local agency (sometimes referred to as a state workforce agency) as being a member of one of 10 targeted groups.

In general, the WOTC is equal to 40% of up to $6,000 of wages paid to, or incurred on behalf of, an individual who:

- Is in their first year of employment with the business;

- Is certified as being a member of a targeted group; and

- Performs at least 400 hours of services for that employer.

However, an employer cannot claim the WOTC for employees who are rehired.

Maximum Credit - Thus, the maximum tax credit is generally $2,400. A 25% rate applies to wages for individuals who perform fewer than 400 but at least 120 hours of service for the employer. Up to $24,000 in wages may be considered in determining the WOTC for certain qualified veterans.

Who Can Claim the Credit - Employers of all sizes are eligible to claim the WOTC. This includes both taxable and certain tax-exempt employers located in the United States and in certain U.S. territories. Taxable employers claim the WOTC against income taxes, and in general, may carry the current year’s unused WOTC back one year and then forward 20 years. “Carrying back” the credit means that the tax return filed for the prior year will need to be amended to claim the credit on that return. The procedure is different for eligible tax-exempt employers; please contact this office for details.

- Qualified IV-A Recipient (relates to Temporary Assistance for Needy Families (TANF)

- Qualified Veteran

- Qualified Ex-Felon

- Qualified Designated Community Resident (DCR)

- Qualified Vocational Rehabilitation Referral

- Qualified Summer Youth Employee

- Qualified Supplemental Nutrition Assistance Program (SNAP) Recipient

- Qualified Supplemental Security Income (SSI) Recipient

- Qualified Long-Term Family Assistance Recipient

- Qualified Long-Term Unemployment Recipient

Pre-screening and Certification - An employer must obtain certification that an individual is a member of the targeted group, before the employer may claim the credit. An eligible employer must file Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, with their respective state workforce agency within 28 days after the eligible worker begins work. Employers should contact their individual state workforce agency with any specific processing questions for Forms 8850. The instructions to Form 8850 provide details about the targeted groups.

Please contact this office for additional information and assistance to determine if hiring family members or hiring individuals who qualify for the WOTC is appropriate for your business.

Tax Changes Coming After 2025

Article Highlights:

- Standard Deductions

- Personal & Dependent Exemptions

- Child Tax Credit

- Home Mortgage Interest Limitations

- Tier 2 Miscellaneous Deductions

- Phaseout of Itemize Deductions

- SALT Limits

- Moving Deduction

- Commuting Tax Benefits

- Personal Casualty Losses

- Estate Tax Exclusion

- Tax Brackets

- Alternative Minimum Tax (AMT)

- Qualified Business Income (QBI) Deduction

Blog - By now you have probably gotten used to the provisions in the Tax Cuts and Jobs Act (TCJA) that became effective January 1, 2018. But don’t forget, most of the tax changes made by the TCJA are not permanent and will expire (sunset) after 2025. This will have an impact on long range tax planning and will result in a mixed bag of tax increases and tax cuts. How it will impact individual taxpayers will depend upon which provisions of TCJA affect them. The following is a review of what will happen when TCJA expires if Congress doesn’t intervene.

Standard Deductions - The standard deduction is that amount of deductions you are allowed on your tax return without itemizing your deductions. The standard deduction is annually adjusted for inflation. In 2018, the TCJA just about doubled the standard deduction as illustrated in the table below that also illustrates the 2023 standard deduction amounts. With expiration of TCJA the standard deduction will be cut roughly in half.

|

HISTORICAL STANDARD DEDUCTIONS |

|||

|

Tax Year |

2017 (pre-TCJA) |

2018 (post-TCJA) |

2023 |

|

Married Filing Joint and Surviving Spouse |

$12,700 |

$24,000 |

$27,700 |

|

Head of Household |

$9,350 |

$18,000 |

$20,800 |

|

Single |

$6,350 |

$12,000 |

$13,850 |

|

Married Filing Separate |

$6,350 |

$12,000 |

$13,850 |

The increased standard deduction under TCJA benefited lower income taxpayers and retirees, whose itemized deductions often were just barely more than the pre-TCJA standard allowance. The increased standard deductions also meant fewer taxpayers claimed itemized deductions – roughly 10% of filers now itemize versus 30% before TCJA – which helped simplify these filers’ returns.

Personal & Dependent Exemptions - Prior to 2018, the tax law allowed a deduction for personal and dependent exemption allowances. One allowance was permitted for each filer and spouse and each dependent claimed on the federal return. For the year prior to the TCJA’s suspension of the exemption deduction, the exemption amount was $4,050, which would have been inflation adjusted to $4,700 in 2023. The deduction for exemptions phased out for higher income taxpayers.

Child Tax Credit – Prior to 2018 the child tax credit was $1,000 for each child below the age of 17 at the end of the year. With the advent of TCJA the child tax credit was doubled to $2,000 for each child below the age of 17 at the end of the year. This more than made up for the loss of a child’s personal exemption deduction for lower income families.

The child tax credit is subject to phaseouts for higher income taxpayers. However, TCJA substantially increased the income phaseout thresholds as illustrated in the table below, so much so that the credit became available to middle-income taxpayers. Also of note is the fact that the phaseout thresholds for the credit are not inflation adjusted. As a result, each year the credit benefit is gradually diminished for higher-income taxpayers.

|

CHILD TAX CREDIT INCOME PHASEOUT THRESHOLDS |

||

|

Filing Status |

Pre-TCJA |

Post-TCJA |

|

Married Filing Joint |

$110,000 |

$400,000 |

|

Married Filing Separate |

$55,000 |

$200,000 |

|

Head of Household |

$112,500 |

$200,000 |

|

All Others |

$75,000 |

$200,000 |

If the credit is allowed to revert to the pre-TCJA amount of $1,000 and the lower income phaseout levels, it will have significant negative impact on families.

You may recall that for one year during the Covid-19 pandemic, the child credit amount was increased to $3,000 or $3,600, depending on the child’s age, and other temporary changes were made. Some in Congress want to permanently bring back these enhancements, so that possibility could become part of any legislation negotiations surrounding the sun setting or extension of TCJA provisions.

Home Mortgage Interest Limitation - Prior to the passage of TCJA taxpayers could deduct as an itemized deduction the interest on $1 Million ($500,000 for married taxpayers filing separate) of acquisition debt and the interest on $100,000 of equity debt secured by their first and second homes. With the passage of TCJA, the $1 Million limitation was reduced to $750,000 for loans made after 2017 and any deduction of equity debt interest laws suspended (not allowed). A return to pre-TCJA levels will tend to benefit higher income taxpayer with more expensive homes and higher mortgages.

Tier 2 Miscellaneous Deductions – TCJA suspended the itemized deduction for miscellaneous deductions for tax preparation fees, unreimbursed employee business expenses, and investment expenses. Most notable of these is unreimbursed employee expenses which allowed employees to deduct the cost of such things as union dues, uniforms, profession-related education, tools and other expenses related to their employment and profession not paid for by their employer. Investment expenses included investment management fees charged by brokerage firms and tax preparation fees, including the cost of tax return preparation and tax planning expenses. These types of expenses were allowed only to the extent they totaled more than 2% of the taxpayer’s adjusted gross income.

Phaseout of Itemized Deductions - Prior to TCJA itemized deductions were phased out for higher income taxpayers. The phaseout thresholds were annually inflation adjusted and for 2017, the year prior to TCJA taking effect, the AGI thresholds were $313,800 for married taxpayers filing jointly (half that for married filing separate), $261,500 for single filers, and $287,650 for those filing as head of household. Under TCJA the phaseouts were suspended, which only benefited higher income taxpayers. If the phaseout is reinstated, it will negatively affect upper income taxpayers, and increase the complexity of their returns.

SALT Limits – SALT is the acronym for “state and local taxes”. TCJA limited the annual SALT itemized deduction to $10,000, which primarily impacted residents of states with high state income tax and real property tax rates, such as NY, NJ, and CA. Several states have developed somewhat complicated work-a-arounds to the $10,000 limits that benefit taxpayers who have partnership interests or are shareholders in S corporations. The elimination of the SALT limitation will favor those residing in states with a state income tax and those with larger property taxes.

Moving Deduction – Prior to the implementation of TCJA taxpayers were able to deduct unreimbursed job-related moving costs where there was an increased commuting distance of 50 miles or more from the prior home and provided the individual worked at the new location full time for 39 weeks of the first 52 weeks (39 weeks first year and 78 weeks in first 2 years for self-employed persons). The moving deduction for active-duty military members was not suspended by TCJA. A restoration of this deduction would benefit taxpayers who are relocating because of job change where the employer is not reimbursing the cost of the move.

Commuting Tax Benefits - Prior to TCJA, an employer could reimburse an employee up to $20 a month for commuting to work on a bicycle, the $20 ($240 annually) was not taxable to the employee, and the employer could deduct the $20. TCJA suspended that benefit for bike commuters for years 2018 through 2025. In addition, although employers can provide a tax-free benefit to employees for transit passes, commuter transportation, and qualified parking, the employer is unable to deduct those expenses under TCJA. For 2023 the maximum monthly exclusion for these fringe benefits is $300 ($3,600 annually). The sunsetting of TCJA may provide an incentive for employers to once again provide the bicycle commuting benefit to their employees.

Personal Casualty Losses – Personal casualty losses are part of the Schedule A itemized deductions. TCJA suspended these losses that did not result from a federally declared disaster. If this deduction is restored, individuals will be able to deduct unreimbursed losses that exceed $100 per casualty and to the extent that these casualties exceed 10% of the individual’s AGI for the year.

Estate Tax Exclusion – TCJA virtually doubled the inflation-adjusted estate and gift tax exclusion as illustrated in the table below. This benefited wealthier taxpayers with larger estates. Also illustrated in the table is the inflation adjusted amount for 2023.

|

ESTATE AND GIFT TAX EXCLUSION |

|||

|

Tax Year |

2017 (pre-TCJA) |

2018 (post-TCJA) |

2023 |

|

Maximum Exclusion |

$5.49 Million |

$11.18 Million |

$12.92 Million |

Most taxpayers have estates well under the pre-TCJA exclusion amount and will not be affected by a restoration of the lower amounts. However, this is not true of wealthier taxpayers, especially considering the estate tax rate is currently 40%.

Tax Brackets – TCJA altered the tax brackets and although most taxpayers benefited, higher income taxpayers benefited the most with a 2.6% cut in the top tax rate. The table only reflects different tax brackets. They may or may not apply to the same levels of income.

|

TAX BRACKETS |

|||||||

|

Pre-TCJA |

10% |

15% |

25% |

28% |

33% |

35% |

39.6% |

|

Post-TCJA |

10% |

12% |

22% |

24% |

32% |

35% |

37% |

A return to the pre-TCJA rates would have the largest negative effect on higher income taxpayers.

Alternative Minimum Tax (AMT) – As part of TCJA Congress did eliminate the Corporate AMT, and even though they had also vowed to eliminate the individual AMT, when the final TCJA was passed, it was still there. But they did include a modest increase of the AMT exemption amounts and a huge increase in exemption amount phase-out thresholds. These, in addition to several other regular tax changes made by TCJA that eliminated certain itemized deductions that caused the AMT in the past, virtually wiped away the AMT for most taxpayers that were affected by it in years before 2018. Depending what changes Congress makes when TCJA expires, the AMT could again cause grief for many taxpayers.

Qualified Business Income (QBI) Deduction – As part of TCJA, Congress changed the tax-rate structure for C corporations to a flat rate of 21% instead of the former graduated rates that topped out at 35%. Needing a way to equalize the rate reduction for all taxpayers with business income, Congress came up with a new deduction for businesses that are not organized as C corporations.

This resulted in a new and substantial tax benefit for most non-C corporation business owners in the form of a deduction that is generally equal to 20% of their qualified business income (QBI). If allowed to sunset with TCJA, businesses (generally small businesses) will lose a substantial deduction.

Of course, these potential changes assume Congress does not extend or alter them. And they aren’t the only tax issues impacted by the December 31, 2025, TCJA sunset date, but are probably those that will affect the most taxpayers. Depending upon your particular circumstances, these possible changes can potentially impact your long-term planning such as buying a home, retirement planning, estate planning, future tax liability and other issues. Please contact this office with any questions.

Is Hobby Income Taxable? Are Hobby Losses Deductible?

Article Highlights:

- Hobby Income

- Form 1099-K

- Hobby Expenses

- Hobby Losses

- Hobby Tax Reporting

- Not-for-Profit Rules

- Determining Factors

- Trade or Business Presumption

- Self-Employment Tax

Are you involved in a hobby that you not only enjoy but that produces income? If so, you may have wondered whether the income is taxable, how the tax law treats hobby-related expenses, and if a net loss is tax deductible. Also to consider is if there’s a net profit, has your hobby now become a business?

Most individuals don’t get involved in a hobby intending to make money from it. But if they do, the tax law says that the hobby income must be reported on their tax return. The IRS has depended on the honesty of hobbyists to include the income on their income tax returns. However, it was relatively easy for individuals to avoid including miscellaneous income from hobbies when their only sources of sales of their products were word-of-mouth sales, flea market sales and such – generally cash transactions with no paper trail.

Nowadays, many individuals sell the merchandise they make as a hobby through online e-commerce sites such as Etsy, eBay, Amazon and others. Congress decided that to rein in unreported income, these sites and third-party payers such as credit and debit card issuers, PayPal, and similar companies should report to the IRS the income received by the selling individuals each year. After a delay implementation of the new rules, IRS has said that starting with tax year 2023, Form 1099-K is to be used to report sales of $600 or more, regardless of the number of transactions. Hobbyists will need to be sure the income shown on the 1099-K is included on Schedule 1 of Form 1040, or otherwise explain why the income isn’t taxable.

Expenses related to a hobby are considered personal expenses which aren’t tax deductible. (Prior to changes included in the Tax Cuts and Jobs Act of 2017, hobbyists were able to deduct expenses up to the amount of their hobby income as a miscellaneous itemized deduction on Schedule A, but this deduction isn’t allowed through 2025.) Thus, hobby income is reported on Schedule 1 of the hobbyist’s 1040 and no expenses are deductible.

Some hobbyists try to get a tax deduction for their hobby expenses by treating their hobby as a trade or a business. By disguising hobbies as a trade or business, and if the hobby expenses exceed the hobby income, they think they can report a deductible business loss. But the tax code includes rules that do not permit losses for not-for-profit activities such as hobbies.

So, what distinguishes a business from a hobby? The IRS considers a number of factors when making the judgment. No single factor is decisive, but all must be considered together in determining whether an activity is for profit. These factors are:

(1) Is the activity carried out in a businesslike manner? Maintaining complete and accurate records for the activity is a definite plus for a taxpayer, as is a business plan that formally lays out the taxpayer’s goals and describes how the taxpayer realistically expects to meet those expectations.

(2) How much time and effort does the taxpayer spend on the activity? The IRS looks favorably at substantial amounts of time spent on the activity, especially if the activity has no great recreational aspects. Full-time work in another activity is not always a detriment if a taxpayer can show that the activity is regular; time spent by a qualified person hired by the taxpayer can also count in the taxpayer’s favor.

(3) Does the taxpayer depend on the activity as a source of income? This test is easiest to meet when a taxpayer has little income or capital from other sources (i.e., the taxpayer could not afford to have this operation fail).

(4) Are losses from the activity the result of sources beyond the taxpayer’s control? Losses from unforeseen circumstances like drought, disease, and fire are legitimate reasons for not making a profit. The extent of the losses during the start-up phase of a business also needs to be looked at in the context of the kind of activity involved.

(5) Has the taxpayer changed business methods in an attempt to improve profitability? The taxpayer’s efforts to turn the activity into a profit-making venture should be documented.

(6) What is the taxpayer’s expertise in the field? Extensive study of this field’s accepted business, economic, and scientific practices by the taxpayer before entering into the activity is a good sign that profit intent exists.

(7) What success has the taxpayer had in similar operations? Documentation on how the taxpayer turned a similar operation into a profit-making venture in the past is helpful.

(8) What is the possibility of profit? Even though losses might be shown for several years, the taxpayer should try to show that there is realistic hope of a good profit.

(9) Will there be a possibility of profit from asset appreciation? Although profit may not be derived from an activity’s current operations, asset appreciation could mean that the activity will realize a large profit when the assets are disposed of in the future. However, the appreciation argument may mean nothing without the taxpayer’s positive action to make the activity profitable in the present.

Because making a determination using these factors is so subjective, the IRS regulations provide that the taxpayer has a presumption of profit motive if an activity shows a profit for any three or more years during a period of five consecutive years. However, if the activity involves breeding, training, showing or racing horses, then the period is two out of seven consecutive years.

Making the proper determination is important because of the differences in tax treatment for hobbies versus trades or businesses. If an activity is determined to be a trade or business in which the owner materially participates, then the owner can deduct a loss on his or her tax return, and it is not uncommon for a business to show a loss in the startup years.

Those with a profit who are truly operating a trade or business will usually be eligible for the Qualified Business Income (QBI) deduction (through 2025) that is generally 20% of the net profit of the business and is deductible in addition to the expenses claimed when figuring the net profit. This deduction, which is allowed without having to itemize deductions, is not permitted if the income is from a hobby.

Another concern for hobbyists who are reporting income from their hobby on their 1040 is whether that income is subject to self-employment (SE) tax. The SE tax is the Social Security and Medicare tax paid by those with a trade or business operated as a sole proprietor. Partners in some types of partnerships also pay SE tax. Luckily, there is an exception for sporadic or one-shot deals and hobbies, which are not subject to self-employment tax.

If you have tax questions related to your hobby activity and how the not-for-profit rules may apply, please give this office a call.

Employee or Independent Contractor – A Primer for Employers and Employees

Article Highlights:

- Distinguishing Employee and Independent Contractor

- State Legislation

- Federal Guidelines

- Partners

- Advantages of Independent Contractor Status

- Form SS-8

- SE Tax

- Form 8919

- Penalties for Misclassifying Workers

- IRS’ Voluntary Classification Settlement Program

It is not uncommon for employers to misclassify employees as independent contractors, either to intentionally avoid their withholding and tax responsibilities or because they are not aware of the laws regarding the issue. Misclassifying a worker can have significant ramifications for both the employer and the worker in terms of how much each pays in income, Social Security, and Medicare taxes, among others. Worker misclassification is a perennial issue for the Internal Revenue Service and state taxing authorities due to the perception that many employers are not properly classifying their workers. This article looks at several issues regarding this matter.

The general distinction, of course, is that an employee is an individual who works under the direction and control of an employer, and an independent contractor is a business owner or contractor who provides services to others.

Whether an individual is an employee or an independent contractor is governed by both federal law and state law. It has always been a complicated issue at both the federal and state levels, and the state and federal guidelines often differ. However, because of the significant payroll tax revenues involved, the states are generally more aggressive in classifying workers as employees.

In recent years several states, including California, Massachusetts and New Jersey, have adopted the so-called ABC test, which is a broad means of determining a worker’s status as either an employee or a contractor by considering three factors. If a worker passes all three, then he or she is an independent contractor. The tests are:

(A) That the worker is free from the hirer’s control and direction, in connection with the performance of the work, both under the contract for the performance of such work and in fact;

(B) That the worker performs work outside the usual course of the hiring entity’s business; and

(C) That the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

To determine whether a worker is an independent contractor or an employee, the IRS examines the relationship between the worker and the business and considers all evidence regarding control and independence. This evidence falls into the following three categories:

(2) Financial control covers whether the business has the right to control the financial and business aspects of the worker’s job. This includes the extent to which the worker has unreimbursed business expenses; the extent of his or her investment in the facilities being used; the extent to which his or her services are made available to the relevant market; how he or she is paid; and the extent to which he or she can realize a profit or incur a loss.

If the business has the right to not only control or direct what is to be done but also how it is to be done, then the workers are most likely employees. On the other hand, if the company can direct or control only the result of the work done, and not the means and methods of accomplishing the result, then the workers are probably independent contractors.

One situation for which there is no uncertainty as to classification relates to a partner in a partnership. The IRS has long held that a bona fide member of a partnership is not an employee of the partnership, and a partner who devotes time and energy to conducting the partnership's trade or business, or who provides services to the partnership as an independent contractor, is considered self-employed and is not an employee.

The obvious advantages for a business to treat an individual as an independent contractor is to avoid paying minimum wages, overtime, payroll taxes, worker’s compensation insurance, unemployment tax, Social Security and Medicare contributions, health benefits, paid leave, 401(k) contributions, and unpaid leave under the Federal Family and Medical Leave Act.

Workers also have some tax-related benefits to being considered independent contractors, such as the ability to deduct certain business expenses that are not available to employees, the eligibility to set up their own retirement plans, and the fact that they are not subject to withholding. Of course, many workers want to be considered employees so they can get the benefits available to employees, such as vacation pay, overtime pay, and health insurance coverage.

When a worker’s status is in doubt, Form SS-8 (Determination of Employee Work Status for Purposes of Federal Employment Taxes and Income Tax Withholding) can be used. This form may be completed by an employer or a worker; it asks the IRS to determine whether the worker is an employee or an independent contractor for federal tax purposes. Form SS-8 is filed separately from the requestor’s tax return. The IRS does not issue determinations for proposed employment arrangements or hypothetical situations, and it will only issue a determination if the statute of limitations for the year at issue hasn’t expired.

An independent contractor will need to pay self-employment (SE) tax on their net self-employment earnings. The SE tax is the individual’s Social Security and Medicare tax contributions. For an employee, the employer pays half of these taxes and the employee pays the other half through their payroll withholding, while a self-employed individual pays 100% of these taxes with their 1040 return using Schedule SE. An individual who is self-employed will not have income tax withheld from the income they receive as an independent contractor and will usually need to make estimated tax payments during the year to cover their income and SE tax liabilities.

If an individual has filed Form SS-8 and the IRS has determined he is an employee, or if an individual believes he or she was misclassified as an independent contractor and wants to avoid paying self-employment tax on 1099-NEC or 1099-MISC income – or when he or she has filed an SS-8 but has not received a response – that individual can file Form 8919, which only requires payment of what would have been withheld if the worker had been treated as an employee. Form 8919 requires the employee to choose one of these codes:

Code A. I filed Form SS-8 and received a determination letter stating that I am an employee of this firm.

Code C. I received other correspondence from the IRS that states I am an employee.

Code G. I filed Form SS-8 with the IRS but have not received a reply.

Code H. I received a Form W-2 and a 1099-NEC or 1099-MISC from this firm for the same tax year. The amount on Form 1099-NEC or 1099-MISC should have been included as wages on the Form W-2.

If using Code H, an SS-8 should not be filed. Here are some examples of amounts that are sometimes erroneously included (but not necessarily deliberately misclassified) on Form 1099-NEC or 1099-MISC and that should have been reported as wages on Form W-2: employee bonuses, awards, travel expense reimbursements not paid under an accountable plan, scholarships, and signing bonuses.

If Code G on Form 8819 is used, both the worker and the firm that paid the worker may be contacted for additional information. Use of this code is not a guarantee that the IRS will agree with the worker’s opinion as to his or her status. If the IRS does not agree that the worker is an employee, the worker may be billed an additional amount for the employment tax, as well as penalties and interest resulting from the change in the worker’s status.

If the IRS determination is for multiple open years, the employee can amend returns for open years to recover a portion of the self-employment tax paid.

A business that misclassifies an employee can be held liable for employment taxes for that worker, as well as owe various penalties, and if the employer willfully misclassified the individual, additional penalties apply and possibly prison time. More penalties could be piled on by the state where the business operates and the misclassified employee could be entitled to back wages for overtime, mandated work breaks, retirement benefits, and more. Misclassifying a worker can be very costly to the employer.

The IRS offers an optional Voluntary Classification Settlement Program that gives businesses an opportunity to reclassify their workers as employees for future employment tax purposes, and offers partial relief from federal employment taxes for eligible businesses who agree to prospectively treat their workers as employees. Businesses must meet certain eligibility requirements and apply by filing Form 8952, Application for Voluntary Classification Settlement Program (VCSP), and enter into a closing agreement with the IRS.

If you have questions about worker status as an employee or independent contractor, please contact this office for assistance.

When Tax Issues Become a Criminal Situation in the Eyes of the IRS

Due to the admittedly complicated nature of the tax code in the United States, the idea that someone might experience issues when filing is not exactly unheard of. Oftentimes people will calculate certain aspects of their returns wrong, fail to submit the necessary paperwork, or something similar. That's part of what amended returns are for - eventually, either you or the IRS will discover the mistake and at that point, things can be properly corrected.

Of course, the chasm between a "minor accident" and "intentional fraud" when it comes to your taxes is a big one, indeed. The latter can get you into a significant amount of trouble and may even venture into criminal territory if you're not careful.

The Case With Criminal Charges and the IRS: What You Need to Know

Whenever this topic comes up, the first question that most people ask involves "What does 'criminal conduct' mean within the context of the IRS, anyway?" The answer, unfortunately, is pretty broad. The government defines it as ANY action you take that violates tax laws or regulations. So if you've claimed a deduction that you weren't entitled to in order to reduce your tax liability, that would be considered criminal conduct. If you underreported your income in an attempt to get a bigger refund, that would be criminal conduct.

Just because that may be true doesn't mean the IRS will prosecute anyone and everyone it finds that falls into this category, however.

Overall, know that the IRS doesn't go to the trouble of pursuing criminal charges for any old taxpayer with a basic filing issue, regardless of how negligent they may be. Ultimately, it will come down to a few different factors including the severity of the issue in question, whether they can prove an intent to defraud, and of course the Statute of Limitations.

To start in the reverse order, know that the Statute of Limitations is the amount of time that the IRS has to legally begin criminal prosecution in the first place. If you haven't filed taxes at all or have underreported your income (and they can prove it), they have six years from the date the correct return was supposed to be in their hands to do anything about it.

If you have a fraudulent return, however - meaning you've intentionally lied about things like your income sources - there is no statute of limitations. So don't make the mistake of assuming you'll be able to "wait them out" on this one.

The IRS will also need to be confident that they'd be able to prove their case should they choose to bring criminal charges. If they suspect something like filing false returns, unpaid taxes, mail fraud, or even bank fraud, the most likely next step will be to begin an investigation. This will likely involve not only the dreaded audit but interviews with yourself and other key witnesses, subpoenas to obtain your financial records like bank statements, and more.

If key evidence is uncovered throughout all this, the Criminal Investigation Division (CID) of the IRS will likely get involved.

Additional Considerations About Your Taxes

Understand that when you're talking about criminal charges and the IRS, this is not a situation to be taken lightly. The average amount of jail time given to people for tax ovation is between three and five years, for example.

But that's not all - you could also easily get fined up to $100,000 (again, depending on the severity of the crime) or up to $500,000 if you're a corporation. The IRS takes all of this incredibly seriously which means that you need to as well.

In the end, all of this helps to underline the importance of making sure that your taxes are done properly in the first place. Obviously, showing an intent to defraud the federal government when filing your taxes is a situation that you would do well to avoid at all costs. But you also want to guarantee that everything is submitted exactly as it should be and that you've ultimately paid everything you owe (whether you like it or not).

Even if you don't rise to the bar of criminality, underpayments, late payments, and other issues could still get you hit with significant fees and other penalties. If you don't feel like you're able to handle things on your own, don't be afraid to enlist the help of an experienced financial professional to do so on your behalf. That way, you'll be able to rest easy knowing that all matters with the IRS are being taken care of.

Your Entrepreneur Start-Up Guide: The Best Practices to Help Motivate Success

Ask any experienced entrepreneur and they will tell you that the difference between running a business and running a successful business is massive. To truly give yourself the best chance of success, and to help achieve your overall goals in the most effective ways possible, there are a number of key best practices you'll want to keep in mind along the way.

The Importance of a Well-Laid Plan

By far, the number one best practice that all successful entrepreneurs lean into has to do with developing not just a business idea, but a thorough, actionable business plan.

How are you going to procure the materials needed to bring that product to life? What design challenges are you going to need to overcome? How big is your market, who are your current competitors, and what does your ideal potential customer look like? These are all the types of questions that you need to answer before you even think about saying that you "run a business."

In five years, if your goal is to open a brick-and-mortar retail location, how do you connect where you want to be with where you currently are? How many employees will you need to make that happen? Where will your initial capital investment come from? Forget five years from now - what does the next fiscal quarter look like?

An actionable business plan breaks the entire process down into a series of smaller, more manageable steps and helps you accomplish your goals more organically.

Listen to Your Customers

Another key thing that early-stage entrepreneurs need to understand in particular has to do with the idea that you shoud always listen to your customers and your marketplace whenever possible.

If you're trying to bring a great new product or service into the world, at a certain point the genesis of that idea is out of your hands. It could be an objectively great product but if the market isn't there, it isn't going to be a success. But if the market is telling you in unison that "this would be better if you changed X, Y, or Z elements" or that they would buy it if "it had A, B, or C features," it is absolutely in your best interest to at least take that all into consideration.

Even though you're an entrepreneur, you are not the ultimate authority on what your business does and how it does it. Your customers have opinions that they are more than willing to share. Being willing to listen to them is often what propels successful entrepreneurs ahead of the pack.

You Are Not the Smartest Person in the Room... Or at Least, You Shouldn't Be

Finally, know that just because you're a passionate start-up entrepreneur doesn't mean you'll be able to "go it alone" forever. Yes, your "can-do attitude" has already gotten you far. There will come a time when you need to give that up and surround yourself with others.

When that time comes, resist the urge to hire people who will simply tell you what you want to hear. In your effort to become a "Jack of All Trades," there will be certain skills that you need that you don't personally have. Surround yourself with smart individuals - preferably those who are smarter than you are - who have those skills.

Likewise, always be proactive about seeking out advice. Participate in networking events and other opportunities to speak to entrepreneurs who have been where you are now. The type of advice they have to offer can be invaluable to understanding what it will take to sustain your vision for the long haul.

Overall, one of the most important things to understand about being an entrepreneur is that everybody's journey is different. There is no "one size fits all" approach to starting a successful business and what works incredibly well for one person may be woefully inadequate for the next.

That is to say, the advice in this list is intended to be exactly that - advice. Find the best practices that generate the results you're after and lean into them as much as possible. When you encounter a technique that doesn't work, move on to the next. Part of being an entrepreneur involves a willingness to try just about anything if it can help them get closer to that goal.

New Employee Onboarding Best Practices: Factors to Consider for Success

If you need a single statistic that underlines the importance of employee onboarding, let it be that one.

Salaries are a huge part of the costs incurred when running a business, yes - but they're also not the only expense of a high turnover. Not only does it delay the ability of your team to drive revenue, but it also significantly hurts employee morale in the long run.

Thankfully, you can take several steps during the employee onboarding process today that will help pave the way for success tomorrow.

The Age of Pre-Boarding is Upon Us

Truly, one of the most important things to understand about all of this is that it's never too early to start preparing someone for their first day on the job. In recent years, many businesses have begun to engage in this prior to the start of the official "onboarding" process.

This is known as pre-boarding, and it can involve a number of things such as:

- Sending a new hire a welcome kit, which can include merchandise like t-shirts with company branding, a laptop or other assets that they'll need once they get started, and more. If nothing else, you'll know that they A) have access to certain tools, and B) you'll have already begun making them feel like they belong.

- Sending "what to expect" messages. This is a great way to get someone's expectations in order as early on in the process as possible. Let them know who they'll be interacting with on their first day, for example, and what items they should bring with them.

- Conduct team introductions. For someone to be at their best, they need to feel like they're contributing to the larger whole. To get to that point, you'll want to introduce new hires to team members even before they begin onboarding in earnest.

Take Care of Administrative Tasks First

Just a few of these tasks include but are not limited to things like:

- Making sure that all necessary security logins to your business' technology, along with building access keys, have been accounted for.

- Setting up a new hire's desk for them complete with necessary equipment like a computer, monitor, cables, adapters, and phone service. At the very least, you should make sure that they have a desk to report to in the first place.

- Create a profile for the new hire (complete with any associated logins) for any attendance tool that you're using.

- If yours is the type of business that hands out uniforms and personalized name tags, these should be among the first things that the employee receives on their first day on the job.

Hit the Ground Running

New employees are always at their best when they're engaged with your business. To get there, they have to be excited about their new job. This means that you should go out of your way to make this person's first day, and the beginning of their larger onboarding experience as exciting as possible.

If scheduling allows, arrange a lovely lunch with this new hire and a few of the people they'll be working with. Send out an email to the entire business that introduces the new employee and lets people know when they'll be starting and how exciting it is that they've arrived. You could even give them a gift for their first day.

In the end, it doesn't matter how much experience a new hire has, or how impressive their resume is. They still need to be onboarded properly. Remember that if a chain is only as strong as its weakest link, your teams are only as strong as their weakest member. Don't let that weak member be someone who wasn't onboarded properly because, in that situation, the only people at fault will ultimately be company leadership.

Why It's Never Too Early to Start a Savings Account for Your Children

Parents - especially new ones - are always looking for new ways to improve the lives of their children. Surprisingly, one of the most effective opportunities that people also often overlook has to do with starting a savings account for that child as early as they're capable of doing so.

On the one hand, no - it's probably not a good idea to give a young child in particular unrestricted access to a bank account filled with money. But that's not the topic under discussion. By starting a savings account for your kids early on in their lives, you put things like compounding interest to work for them (and you). Not only that, but you begin to lay the building blocks of a larger financial education that will serve them well for years to come.

The Impact of Compounding Interest

While terms like "compounding interest" may sound complicated, the idea at the heart of them is anything but. It simply means that any investment you make will generate interest, which means that the investment grows over the next period of time.

Things get even more impressive if you open a dedicated investment account, which typically has an annual return of about 7%. Here, if you'd made that same $60 per month contribution, the child would have $7,829 by the time they turn 18. Open the same account when they're born and continue to make the same contribution and that number climbs to $26,337. If you fund it even more the growth is substantial.

All this is because of the major benefits that compounding interest brings with it. When your interest earns its own interest, soon the idea of generating a substantial return on your investment becomes something of a self-fulfilling prophecy. At that point, the momentum of the account should motivate you to keep contributing. It will also represent an excellent educational opportunity for your family to show your child just what can happen when they put the money they're earning to work for them.

It's About Building a Foundation

Beyond that, it's always a good idea to open up something like a Roth IRA for your kids - particularly so that they're able to start saving for retirement as soon as possible. Unlike older adults, in particular, your kids have literally decades for any contributions that they make to grow. Not only do they grow tax-free, but when you hit retirement age, those contributions can also be withdrawn tax and penalty-free as well.

Truly, it's a great thing that there are no age limits when it comes to custodial Roth IRAs because "there is no time like the present" to get one started. Your kids will need to have their own earned income (so they need to be legal working age) and they have to obey contribution limits, but all of this can help them understand what saving is and why it matters so much.

The best part of all is that with many financial institutions, opening a custodial Roth IRA can take a half hour or less.

Overall, it's important to think about many of the financial tips, tricks, and best practices you hear about later in life. When adulthood has set in and you're actively worried about pesky topics like "paying bills" or "saving for retirement," you typically always hear two key things:

- It's never too late to start saving for a better future, but

- It's certainly never too early, either.

Most people get to a point where they wish they'd started saving a bit earlier than they really did and now, by setting up a savings account for your children, you have the opportunity to make sure this isn't something that they spend time stressing about. At the very least, they'll have a little extra money stashed away for a proverbial "rainy day" that will help out later on.

But in the best-case scenario, you'll have started them on a critical path to financial literacy that will give them a better shot at making the best possible decisions when it comes to their financial future. The importance of this simply cannot be overstated, regardless of how old they are.

What You Should Know About the Chart of Accounts in QuickBooks Online

It works in the background as a critical element of QuickBooks Online. Understanding the role of the Chart of Accounts

There are still many millions of small businesses that won’t use accounting software. Expenses may be an issue for some of them, as well as hesitation to change the way they manage their money. The number one reason for this reticence, though, maybe the mistaken notion that you have to have a good understanding of the accounting process in order to use an online solution.

If you’ve already been using QuickBooks Online, you know this isn’t true. The site was designed for businesspeople, not accountants. It does all of the official bookkeeping in the background while you work with familiar language and processes. Still, there are a few elements that may be foreign to you.

The Chart of Accounts is one of these. You don’t have to do anything with it—in fact, we suggest that you don’t—but you’ll encounter it when you work with some transactions and records and reports.

Your Accounting Backbone

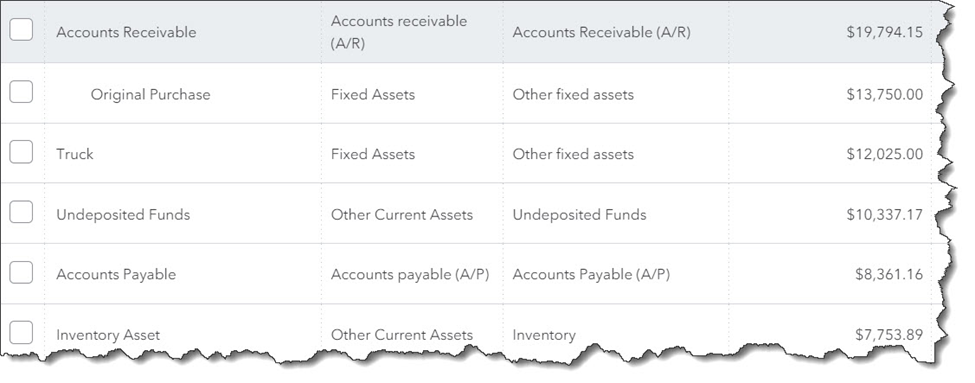

The Chart of Accounts is simply a list of financial categories that is used to track your company’s financial data. QuickBooks Online creates one for you that’s based on the business type and industry you chose when you were setting up your company data file. You can access it through an icon on your home page or by clicking the gear icon in the upper right of the page.

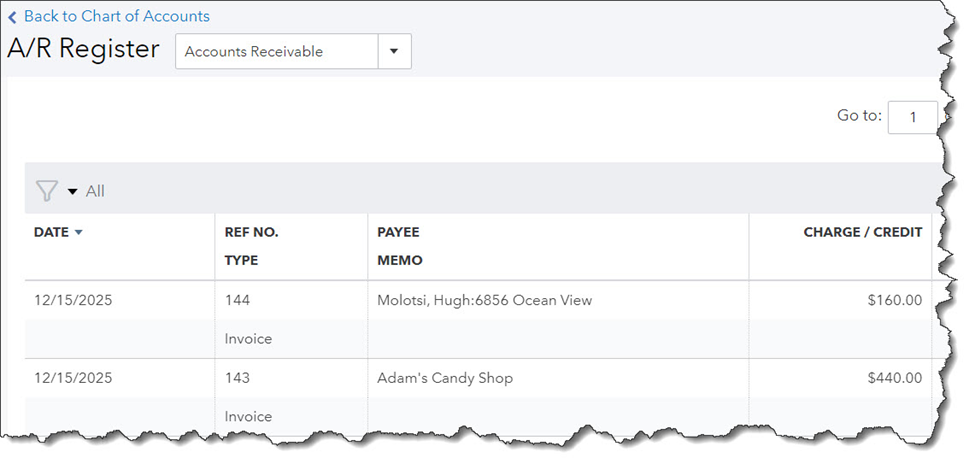

A section of QuickBooks Online’s Chart of Accounts

Some people call the Chart of Accounts the “backbone” of your accounting system. We think it’s more like the nervous system. When you feel a pain in your big toe, for example, you can identify the nerve that’s involved. And when an account is assigned to a record or transaction, you can trace it to a specific element of your overall financial picture. So when you create an invoice, for example, you know you can find it in your accounts receivable (A/R) register. Inventory items are actually assigned to multiple accounts by default.

QuickBooks Online knows where to route data that you’ve entered. Please don’t change these accounts without checking with us first.

What’s In the Chart of Accounts?

As you can see in the above image, your chart of accounts contains columns for Name, Account Type, and Detail Type. Accounts feed into one of two QuickBooks Online financial reports, either Balance Sheet or Profit & Loss. These are reports that the site can generate automatically, but we recommend you let us create and interpret them for you. They’re not as easy to understand as an accounts payable aging report, for example.

QuickBooks Online automatically determines which Account Type should be assigned to an account. Balance Sheet accounts have opening balances. They include:

- Assets (checking and savings accounts, accounts receivable, inventory assets, etc.)

- Liabilities (unpaid bills and outstanding credit card balances, sales taxes owed, loans, etc.)

- Equity (owners’ financial contributions)

You can view the registers for some individual accounts from the QuickBooks Online Chart of Accounts.

The remainder of the accounts in QuickBooks Online’s Chart of Accounts are used in the Profit & Loss report (or, Income Statement). They include:

- Income (product sales, etc.)

- Expenses (job expenses, payroll expenses, etc.)

- Cost of Goods Sold (labor, shipping, materials and supplies, etc.)

- Other Income and Other Expenses

What’s So Important About the Chart of Accounts?

It’s absolutely critical that the Chart of Accounts is comprehensive and correct. This means that you shouldn’t alter what QuickBooks Online has prepared for you on your own. If you feel that your Chart of Accounts needs changing, please contact us. The best thing to do is understand it, but leave it alone.

There are several reason why this lengthy list of accounts is so important, but it all boils down to registers and reports. You want your account registers to be accurate, containing only the correct entries. And your Chart of Accounts produces the reports that you’ll need when you:

Prepare income taxes. Your reportable income and deductible expenses will be incorrect if your account assignments are off.

Seek funding. Your numbers must be pristine if you’re planning to apply for a loan or take on investors or sell your company.

Monitor your finances. A flawed Chart of Accounts will not present a true representation of your income and expenses. This makes it difficult to analyze your company’s financial health and plan for a prosperous future.

To recap, remember these three things:

- An accurate Chart of Accounts is essential.

- It’s unlikely that you’ll ever have to do anything to change it.

- Let QuickBooks Online handle this critical foundation for your accounting data.

We provided this brief explanation of QuickBooks Online’s Chart of Accounts because we wanted you to have a basic understanding of this feature when you spot it during your daily work. If anything we’ve said isn’t clear, or if you have a question about your own accounting setup, please do let us know.

August 2023 Individual Due Dates

August 10 - Report Tips to Employer

If you are an employee who works for tips and received more than $20 in tips during July, you are required to report them to your employer on IRS Form 4070 no later than August 10. Your employer is required to withhold FICA taxes and income tax withholding for these tips from your regular wages. If your regular wages are insufficient to cover the FICA and tax withholding, the employer will report the amount of the uncollected withholding in box 8 of your W-2 for the year. You will be required to pay the uncollected withholding when your return for the year is filed.

Weekends & Holidays:

If a due date falls on a Saturday, Sunday or legal holiday, the due date is automatically extended until the next business day that is not itself a legal holiday.

Disaster Area Extensions:

Please note that when a geographical area is designated as a disaster area, due dates will be extended. For more information whether an area has been designated a disaster area and the filing extension dates visit the following websites:

FEMA : https://www.fema.gov/disaster/declarations

IRS: https://www.irs.gov/newsroom/tax-relief-in-disaster-situations

For example, disaster-area taxpayers in most of California and parts of Alabama and Georgia now have until Oct. 16, 2023, to file various federal individual and business tax returns and make tax payments.

August 2023 Business Due Dates

August 10 - Social Security, Medicare, and Withheld Income Tax

File Form 941 for the second quarter of 2023. This due date applies only if you deposited the tax for the quarter in full and on time.

August 15 - Social Security, Medicare, and Withheld Income Tax

If the monthly deposit rule applies, deposit the tax for payments in July.

August 15 - Nonpayroll Withholding

If the monthly deposit rule applies, deposit the tax for payments in July.

Weekends & Holidays:

If a due date falls on a Saturday, Sunday or legal holiday, the due date is automatically extended until the next business day that is not itself a legal holiday.